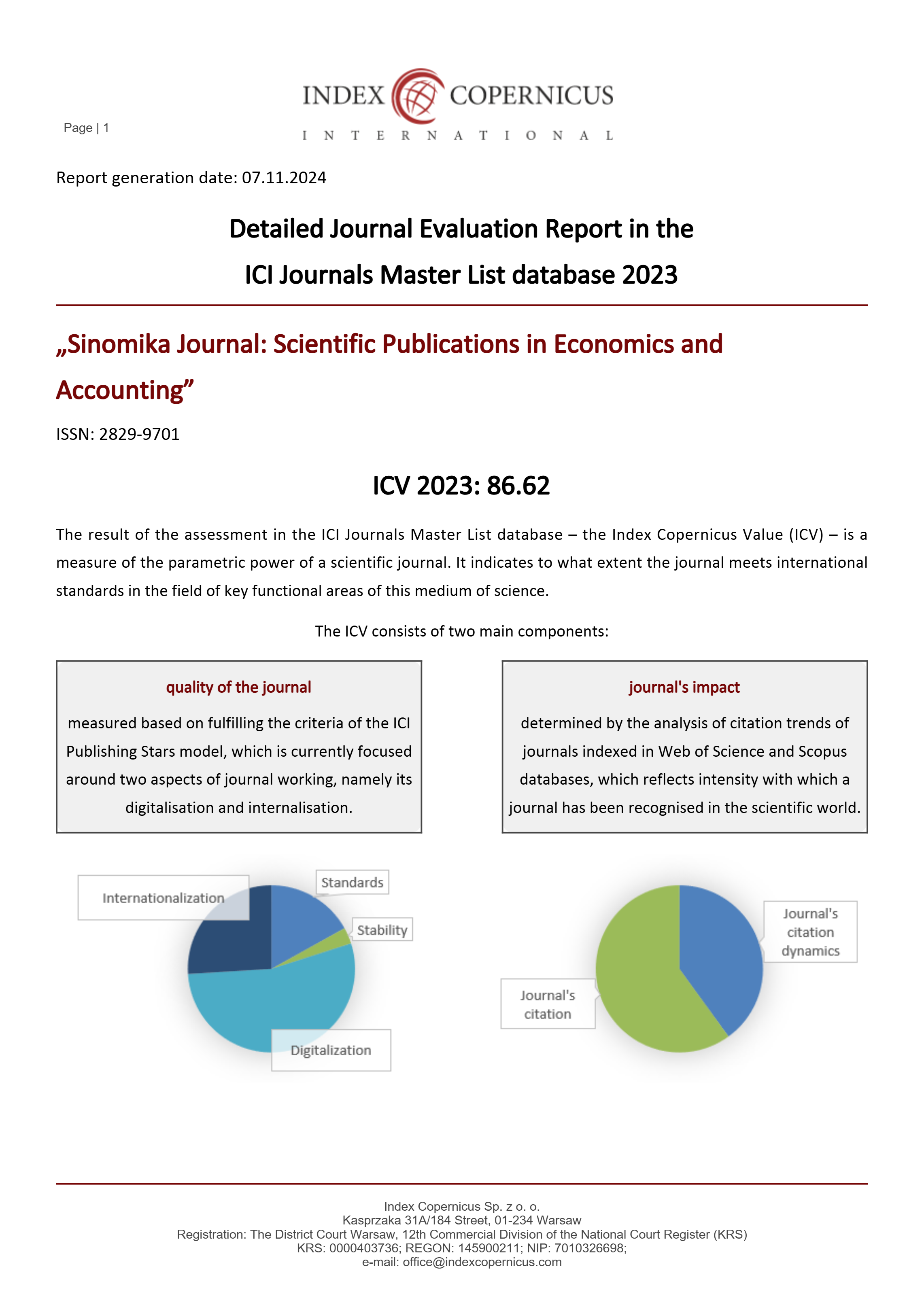

Pengaruh Intangible Asset dan Tunneling Incentive terhadap Tax Avoidance dengan Profitabilitas sebagai Variabel Moderasi

DOI:

https://doi.org/10.54443/sinomika.v2i4.1578Keywords:

Intangible Asset, Tunneling Incentive, Tax Avoidance, ProfitabilityAbstract

The purpose of this study was to determine the effect of intangible assets and tunneling incentive on tax avoidance and to determine whether profitability can moderate intangible assets and tunneling incentive on tax avoidance in food and beverage sub-sector manufacturing companies listed on the Indonesia Stock Exchange for the period 2018-2022. The population in this study are food and beverage sub-sector manufacturing companies listed on the Indonesia Stock Exchange for the period 2018-2022. The research population is also included in the scale of multinational companies. Sampling in this study was conducted using a nonprobability sampling approach. The technique used to determine the sample in this study was purposive sampling. The type of data required in this study is secondary data in the form of financial statements. These results show different relationships between intangible assets and tunneling incentive on tax avoidance, as well as the relationship between profitability in moderating intangible assets and tunneling incentive on tax avoidance.

Downloads

References

Ariesco Wijaya, R., & Suganda, R. (2021). Pengaruh investment opportunity set, kinerja keuangan, dan intangible asset terhadap nilai perusahaan. AKUNTABEL, 17(2), 2020–2215. http://journal.feb.unmul.ac.id/index.php/AKUNTABEL

Artini, N. M., & Setiawan, P. E. (2021). Pengungkapan Corporate Social Responsibility dan Penghindaran Pajak dengan Profitabilitas sebagai Variabel Moderasi. E-Jurnal Akuntansi, 31(9), 2277. https://doi.org/10.24843/eja.2021.v31.i09.p10

Ayu Nurulita, N., Yulianto, A., Akuntansi, J., Ekonomi, F., & Negeri Semarang, U. (2023). Pengaruh Profitabilitas, Institutional Ownership, Corporate Social Responsibility, dan Tunneling Incentive terhadap Tax Avoidance. In Jurnal Pustaka Nusantara Multidisplin) (Vol. 1, Issue 1). www.idx.co.id.

Ekombis Review -Jurnal Ilmiah Ekonomi dan Bisnis, J., Aminah Azzuhriyyah, A., Studi Akuntansi, P., & Ekonomi dan Bisnis, F. (2023). Pengaruh Tunneling Incentive, Intangible Asset, dan Debt Covenant Terhadap Keputusan Transfer Pricing Dengan Tax Minimization Sebagai Variabel Moderasi Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Tahun. Jurnal Ekombis Review, 11(1), 11. https://doi.org/10.37676/ekombis.v11i1

Haliyah, S. N., Saebani, A., Setiawan, A., Nasional, P., & Jakarta, V. (2021). PROSIDING BIEMA Business Management, Economic, and Accounting National Seminar.

Hidayat, W. W., Winarso, W., & Hendrawan, D. (2019). Pengaruh Pajak dan Tunneling Incentive Terhadap Keputusan Transfer Pricing Pada Perusahaan Pertambangan yang terdaftar di Bursa Efek Indonesia (BEI) Periode 2012-2017. Jurnal Ilmiah Akuntansi Dan Manajemen (JIAM), 15(1). www.idx.co.id.

Ilmiah, J., & Akuntansi, K. (2022). Pengaruh Leverage, Capital Intensity dan Profitabilitas Terhadap Tax Avoidance. 15(2), 326–333. http://journal.stekom.ac.id/index.php/kompakpage326

Jasmine Dwi Santosa, S., & Suzan, L. (2018). Pengaruh Pajak, Tunneling Incentive dan Mekanisme Bonus Terhadap Keputusan Transfer Pricing (Studi Kasus pada Perusahaan Sektor Industri Barang Konsumsi yang Terdaftar di Bursa Efek Indonesia Tahun 2013-2016) The Influence Factors of Tax, Tunneling Incentive and Bonus Mechanism on Transfer Pricing Decision (The Case Study on a Consumer Goods Industry Sector Companies Listed on The Indonesian Stock Exchange During 2013-2016) (Vol. 19, Issue 1).

Kusuma Wardani, D., Taurina, Y., Ekonomi, F., & Sarjanawiyata Tamansiswa, U. (2022). Pengaruh Capital Intensity Terhadap Tax Aggressiveness Dengan Profitabilitas Sebagai Variabel Moderasi (Vol. 13).

Manrejo, S., Nuryati, T., Pangaribuan, D., Amaliah, A., & Prasetyo, J. H. (2023). Remittances Review Factor Affecting Individual Taxplayer Compliance in indonesia. 4, 2268–2285. https://doi.org/10.33182/rr.v8i4.157

Nafhilla, D. (2022). Pengaruh Tax Planning, Profitabilitas, Dan Inventory Intensity Terhadap Tax Avoidance. Jurnal Literasi Akuntansi, 2(3), 186–191. https://doi.org/10.55587/jla.v2i3.68

Pujilestari, R., & Winedar, M. (2018). Pengaruh Karakter Eksekutif, Ukuran Perusahaan, Kualitas Audit, dan Komite Audit Terhadap Tax Avoidance. In Jurnal Akuntansi dan Auditing (Vol. 15, Issue 2).

Purwanti, I., & . M. (2019). Pengaruh Intangible Asset Terhadap Kinerja Keuangan Dengan Keunggulan Bersaing Sebagai Mediasi. MIX: JURNAL ILMIAH MANAJEMEN, 9(1), 72. https://doi.org/10.22441/mix.2019.v9i1.005

Puspita1, E. R., Nurlaela2, S., & Masitoh3, E. (2018). Seminar Nasional dan Call for Paper.

Putra, R. J., & Rizkillah, A. A. (2022). Effect Tunneling Incentive, Intangible Assets, Profitability on Transfer Pricing Moderation Tax Avoidance. https://doi.org/10.33258/birci.v5i2.5304

Ramdiani, E. N., Gunarsih, T., & Lestari, E. P. (2023). Analisis Faktor-Faktor yang Mempengaruhi Tax Avoidance. Owner, 7(2), 1283–1293. https://doi.org/10.33395/owner.v7i2.1367

Saputro, S. U., Nurlaela, S., & Dewi, R. R. (2021). Pengaruh Ukuran Perusahaan, Profitabilitas, Leverage, Likuiditas Terhadap Tax Avoidance Pada Perusahaan Sub Sektor Otomotif Yang Terdaftar Di BEI Periode 2014-2019. Jurnal Akuntansi Dan Pajak, 22(1), 304. https://doi.org/10.29040/jap.v22i1.1919

Sari, K., & Somoprawiro, R. M. (2020). Pengaruh Corporate Governance, Koneksi Politik, Dan Profitabilitas Terhadap Potensi Tax Avoidance. In JURNAL AKUNTANSI (Vol. 9, Issue 1). http://ejournal.stiemj.ac.id/index.php/akuntansi

Sukma, C., Riris, W., & Sitorus, R. (2019). Pengaruh Transfer Pricing dan Sales Growth Terhadap Tax Avoidance Dengan Profitabilitas Sebagai Variabel Moderating (Vol. 4, Issue 2). http://journal.uta45jakarta.ac.id/index.php/MAP

Wihandayani, S., Supriyanto, J., & Budianti, D. W. (2019). Pengaruh Pajak Dan Tunneling Incentive Terhadap Transfer Pricing Pada Perusahaan Sub Sektor Otomotif Dan Komponen Yag Terdaftar Di Bursa Efek Indonesia Periode 2008-2017.

Yunita, N., & Halim, S. (n.d.). Pengaruh Aset Tidak Berwujud, Leverage dan Tingkat Pengembalian Aset serta Pengaruhnya terhadap Nilai Perusahaan. www.DeepL.com/pro

Zarkasih, E. N., & Maryati, M. (2023). Pengaruh Profitabilitas, Transfer Pricing, dan Kepemilikan Asing Terhadap Tax Avoidance. Ratio : Reviu Akuntansi Kontemporer Indonesia, 4(1). https://doi.org/10.30595/ratio.v4i1.15567

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Meisya Refi Fadilla, Tutty Nuryati, Elia Rossa, Dewi Puspaningtyas Faeni, Sumarno Manrejo

This work is licensed under a Creative Commons Attribution 4.0 International License.